- Call Now: (949) 334-7823 Tap Here to Call Us

Top 10 Reasons Why Estate Planning is Important

10 Reasons Why It’s Important to Have an Estate Plan

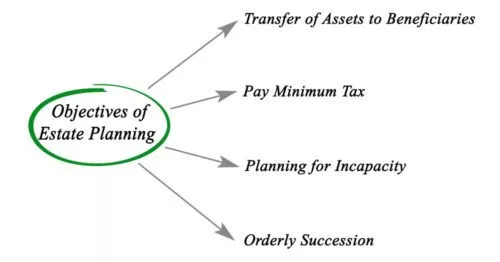

Proper estate planning ensures that you control the distribution of your assets. It also protects your family, avoids taxes, and eliminates future controversies. Bottom line, it makes sure you have a trusted party to protect your affairs. If you want your loved ones and assets protected after you’re gone, you’ll need an estate plan.

Comprehensive estate planning isn’t only about managing your assets after death. It’s about lifetime planning, too. Lifetime planning may include creating living trusts to protect property and incapacity planning that may include a durable power of attorney and health care power of attorney. Contrary to a popular misconception, estate planning is for everyone regardless of wealth.

You should think about the distribution of your estate any time you experience a major life change. Switching careers, starting a family, and getting married should all prompt a review of your estate plan. As promised, here are ten reasons why estate planning is important:

10. Get an Accurate Picture of Your Financial Situation

Estate planning involves a detailed analysis of your current financial situation. In order to develop an accurate and achievable plan for the future, it is important to know what you have in terms of assets and debts today. Most people start by gathering together any documentation they have with respect to each asset and debt. This includes bank statements, investment documentation, real estate appraisals, and other approximations of value regarding other assets. You may also want to write down a list of personal items of high value that you want to gift to others.

For example, you may want to leave a diamond ring to a particular child or an expensive piece of original art to another. Specifying that you want these individual items to be gifted will prevent your estate from selling them and dividing the proceeds among your beneficiaries. It can also help you find ways to distribute your assets in an equitable way. This will reduce the risk that one beneficiary will try to contest the will.

Visiting an estate planning attorney now will also help your estate trustee or executor manage your estate later. Creating an estate plan requires marshaling all relevant information about your assets. This information will include transaction and account numbers as well as the location of those assets. Family members do not often have this information. Sorting through financial records after someone has passed away can be difficult. If your attorney already has this information on file, it can help make distribution much easier.

9. Prevent Lengthy Legal Battles Over Your Estate

If you die without a binding will or comprehensive estate plan, your family members may become involved in lengthy legal disputes about your estate. The same is true if you become mentally incapacitated while alive but have not yet appointed someone to manage your affairs. Events like these are very stressful occasions, and not all families are able to manage them well. In some cases, family members with conflicting points of view find themselves fighting each other about your wishes.

These legal battles are as costly as they are long. Your estate will have to pay legal fees out of your remaining assets. This can dramatically reduce the amount available for payout to beneficiaries at the end of the court proceedings. Planning out in advance how you want your assets to be distributed will go a long way to avoiding this type of legal mess. To avoid unnecessary legal battles, it’s critical that get qualified advice from an attorney. Your lawyer can arrange your estate to minimize confusion over your wishes.

8. Avoid Taxation

Contrary to popular belief, most of the money your estate loses following death goes to taxes, not legal fees. It’s essential to have a skilled estate planning attorney and accounting professionals. Your team can help cut the state, federal, and inheritance taxes payable by your estate. Most people lack this type of specialized knowledge. It is crucial to meet with an estate planning attorney to ensure that you are able to leave as much as possible to your loved ones. They can also help you care for your family now, while still helping you set aside as much as possible for eventual distribution.

Individuals with complex assets including real estate, businesses and investments, should never try to draft estate documents on their own. Even the smallest errors in drafting can interfere with your plan. An estate law professional will be able to draft a binding document and assist with tax avoidance.

7. Incapacity Planning: Ensure You Are Well Cared for While Alive

Estate planning involves more than thinking about what happens after death. It also means considering how you want your assets managed while you’re living. Incapacity planning involves drafting a document setting out who you want to manage your affairs while you are still alive. This individual does not have to be the same person that you name as your estate trustee or executor. This may be one document, discussing both financial and medical concerns. In some states, lawyers will draft two separate documents. You can name the same person on both documents, or two different people depending on your needs.

Again, it is crucial that you seek professional legal advice when thinking about these matters. Your lawyer can help you choose an appropriate individual. For example, some people may want to use their spouse as their medical proxy. This is a great idea in most situations. Yet, you may also want to name an alternative as well to guard against your spouse predeceasing you or becoming incapacitated. Your attorney can help you identify any potential issues with the people you have selected. They will draft the documents to avoid legal complications in the future.

If you have minor children, you should also use these documents to appoint a guardian. Most people do not consider mental incapacity as a serious concern when they are younger. But, accidents can happen at any time, some have unanticipated medical consequences.

6. Protect Your Business

If you are a business owner, it is crucial that you invest in estate planning. Small business succession is a complicated legal process. It is not as easy as specifying who you want to take over the company in your will. You should look for an attorney with corporate and estate law specialties. Be sure you involve your accountant as well. In some cases, you may need to sign a consent form in order for all these individuals to communicate.

You will need to think about who you want to run the company after you are gone. You should consider things like the day-to-day operation of the business as well as the behind the scenes financial work. The most ideal person for this position will depend on your unique circumstances. Sometimes it is a trusted business associated. In other cases, you may want to pass part of the company along to your children. Talk with your estate planning team about the best way to ensure that your company continues to run smoothly. Your attorney can help draft documentation and begin organizing your company’s legal structure to accommodate your future needs. Bring copies of your business’ legal and financial records with you to your first meeting. Your legal and financial team will want to have an accurate picture of your company’s structure before offering legal and financial advice.

5. Avoiding Probate

If you die without planning your estate, the State, through the probate process, decides who receives your assets and in what amount. Each state has different succession rules, but most of them will pass assets to your spouse and children. They do not leave room for any other bequests or specific gifts. For example, if you wanted a particular child to receive a certain item, you would have to hope that your trustee was aware of your wish and would comply with it. Otherwise, that asset could wind up in the hands of your spouse, or liquidated with the proceeds divided.

Also, if you die without a will or estate plan you cannot leave any money to charities or other organizations. When the state decides how to split up your assets, they only consider relatives as beneficiaries. They will not permit the appointed executor or trustee to give any money to third parties, including charities. Individuals who want to leave fund to friends, other organizations, or charities need to plan out their estate to ensure such bequests are fulfilled.

Hiring an estate planning attorney to draft a comprehensive estate plan will ensure that any bequests made to family and non-family members are honored. Homemade wills are subject to a higher degree of scrutiny by the counts than those drafted by attorneys. If there is any question about your mental capacity at the time the will was created, a court could deem that bequest to be void. By hiring an attorney, you can mitigate the risk that your estate documentation will see legal challenges.

4. Reduce Stress on Your Family Members

Coping with grief is a very difficult thing for most people. Trying to manage an estate of someone who died without a will or estate plan adds a significant amount of stress to the situation. Not only does the State determine asset distribution, it also selects a person to act as your executor or trustee. This may not be the same individual you would have selected if you had the chance.

Funeral arrangement is also another key part of estate planning. Arranging and paying for a funeral is very stressful. It’s a tough task to take on even at the best of times. Dealing with grief while making speedy funeral arrangements can be overwhelming. It’s a great idea to plan your funeral arrangements ahead of time. Prepaying and arranging for your funeral and burial or cremation will help your family focus on healing after your death.

Paying for your funeral in advance can also save your beneficiaries money. After death, any expense incurred comes out of your estate. Planning for this expense in advance will often reduce the expense. It also helps your family understand your wishes about funeral arrangements. This can also relieve a lot of stress during an uncertain time.

3. Asset Protection

Comprehensive estate planning takes into account asset distribution, incapacity planning asset protection.

Asset protection—like most things in life—is all about the timing. Not much good can come from trying to protect your assets reactively when surprised by situations like bankruptcy or divorce. To take full advantage of asset protection using estate planning is to prepare proactively long before these things ever come to pass — and hopefully many of them won’t. This paragraph is the tip of the ice berg of asset protection planning but, in essence, there are two general types. Asset protection for yourself and asset protection for your heirs.

Asset protection planning for yourself must be performed long in advance of any proceedings that might threaten your assets, such as bankruptcy, divorce, or judgement. There are highly-detailed rules and regulations surrounding this type of asset protection, it’s important to lean on your estate planning attorney’s expertise.

Asset protection for your heirs involves setting up discretionary lifetime trusts rather than outright inheritance, staggered distributions, mandatory income trusts, or other less protective forms of inheritance. The different strategies offer variable grades of protection. For example, a trust that has an independent distribution trustee who is the only person empowered to make discretionary distributions offers much better protection than a trust that allows for so-called ascertainable standards distributions. Don’t worry about the complexity – I am here to help you best protect your heirs and their inheritance. This complex area of estate planning is full of potential miscalculation, so it’s crucial to obtain qualified advice and not rely on common knowledge about what’s possible and what isn’t.

2. Give Yourself Peace of Mind

The best reason to start planning your estate now is to give yourself peace of mind. Regardless of where you are in life, there are people you will want to care for after your death. Ensuring that you have a binding estate plan means that these individuals will be looked after following your death. Parents with young children in particular may feel a lot of anxiety about their children’s futures should anything go wrong. Preparing guardianship clauses and designating a trustee for their future financial needs will relieve that stress. It also gives you a chance to integrate those people in your child’s life now. For example, you may want one of your siblings to act as guardian should anything happen to you and your spouse. Familiarizing your child with that person now can help reduce your child’s stress levels if the worst were to occur. Many parents take comfort in knowing they are doing all they can now to help their child should something go wrong later.

Estate planning involves more than deciding who receives what in the event of your death. It also includes planning for other, worst-case scenarios. Preparing documentation to help protect your assets and provide for your care should you become incapacitated is important. This guarantees that someone you trust will look out for your well-being, even when you are not able to yourself. Taking steps to ensure these wishes are binding now can help you and your family in the future.

1. Protect Your Loved Ones

You should review your estate plan every year, or upon any major life change. Things like having children or the marriage of a change your estate plan. In some cases, you may want to develop a way to protect your beneficiaries after they receive their bequest.

Adult beneficiaries may also need some degree of protection. Most states will require a guardian or conservator if the beneficiary has mental or developmental challenges. Keep this in mind if you do have any beneficiaries in this situation. You may also want to speak with your legal team about adult children who are bad with money or who have a troubled marriage. There are certain ways you can phrase your gift to protect it from themselves, or their partners. You may also want to speak with your lawyers about protecting your assets in the event of lawsuits, either before or after death. The best time to ensure your loved ones receive as much of your estate as possible is now. If you wait until you have concerns about a specific lawsuit, it may be too late to do anything about it.

Regardless of your financial situation there are important reasons for you to have an estate. Even if you do not think you have enough assets to warrant a full estate plan, you should still seek legal advice. Estate planning can help your family when dealing with grief. It can ensure that your wishes are followed after death. Developing an estate plan will also ensure that your loved ones, even non-family members, are cared for the way you intend. It is an especially important task for families with young children. You want to be sure that your children are raised well and receive the best possible care. A comprehensive estate plan organizes your assets, documents your wishes, and protects your family.

You should revisit your estate plan annually. I recommend a quick review at tax time or when there is a major life change. The birth of children or grandchildren should prompt a review. You should also take a look at your estate documentation upon marriage or divorce, either yours or that of a beneficiary. Be sure you keep your attorney advised about any major purchases or sales as well. While most asset exchanges do not require a revision of your estate plan, some may. It is important that you share this information with your attorney to avoid any complications in distributing your estate in the future. One of the best things you can do for your family is to plan out your estate now. It will reduce a significant amount of stress, and protect them in the event of your death.

This article is a service of the Law office of Jonathan D. Alexander. I don’t just draft documents; I ensure you make informed decisions about life and death, for yourself and the people you love. That’s why I offer a free family wealth planning consultation. You will get more financially organized than you have ever been. You’ll also make the best choices for the people you love. Call my office today to schedule a free consultation.